Getting The Pacific Prime To Work

Your representative is an insurance coverage professional with the expertise to lead you via the insurance process and aid you locate the most effective insurance protection for you and individuals and points you care concerning most. This article is for informational and recommendation purposes just. If the plan insurance coverage summaries in this short article conflict with the language in the policy, the language in the plan applies.

Policyholder's deaths can also be contingencies, especially when they are considered to be a wrongful fatality, in addition to residential property damage and/or damage. Due to the unpredictability of claimed losses, they are classified as backups. The guaranteed individual or life pays a premium in order to obtain the advantages guaranteed by the insurer.

Your home insurance can help you cover the problems to your home and pay for the cost of restoring or repair services. Often, you can also have insurance coverage for items or valuables in your house, which you can then purchase replacements for with the cash the insurer gives you. In case of an unfortunate or wrongful fatality of a sole earner, a family members's economic loss can potentially be covered by particular insurance strategies.

Fascination About Pacific Prime

There are numerous insurance policy plans that include savings and/or financial investment plans in addition to routine coverage. These can aid with building cost savings and wide range for future generations via regular or reoccuring financial investments. Insurance coverage can help your family maintain their requirement of living in case you are not there in the future.

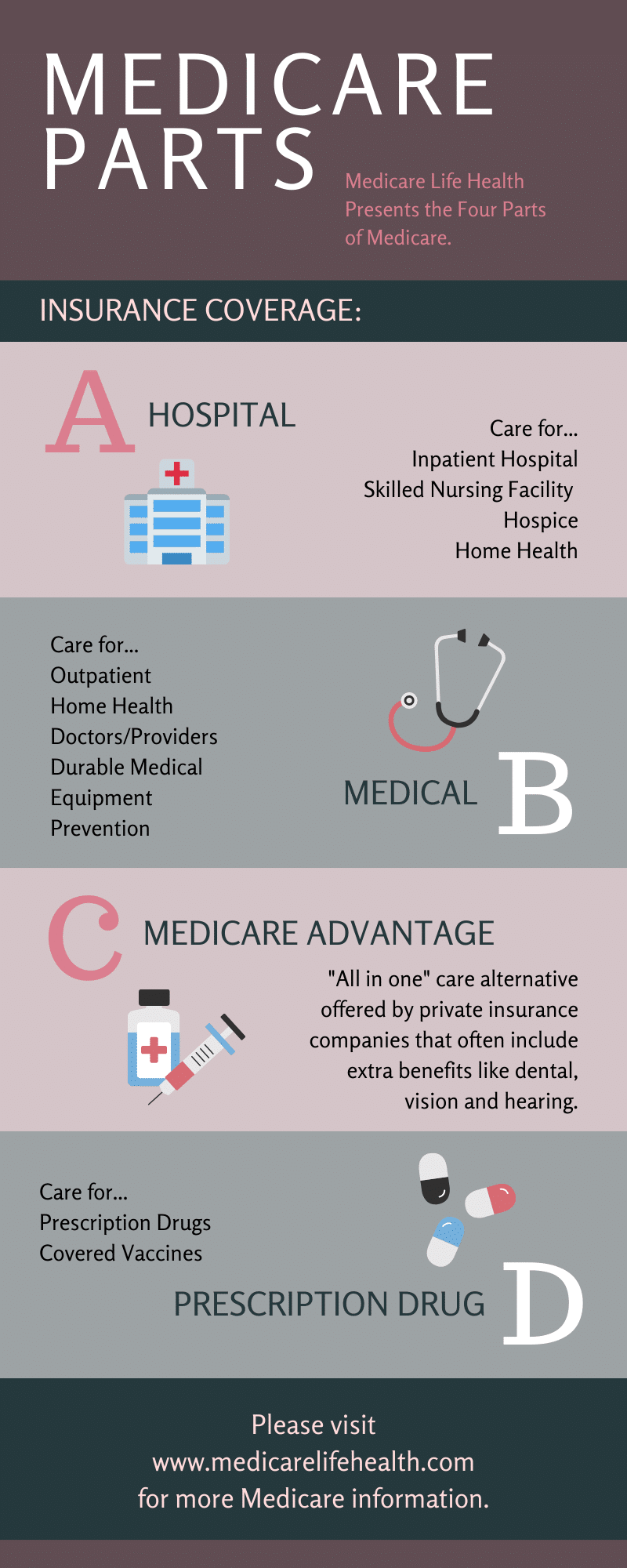

One of the most fundamental type for this kind of insurance coverage, life insurance policy, is term insurance policy. Life insurance policy generally assists your family come to be secure economically with a payout quantity that is given up the event of your, or the plan owner's, fatality throughout a particular policy period. Kid Plans This sort of insurance is primarily a financial savings instrument that assists with producing funds when kids reach particular ages for going after greater education.

Home Insurance coverage This sort of insurance coverage covers home damages in the occurrences of accidents, natural disasters, and problems, along with other similar occasions. group insurance plans. If you are blog seeking to seek settlement for mishaps that have happened and you are struggling to find out the proper course for you, connect to us at Duffy & Duffy Law Office

Pacific Prime for Beginners

At our law practice, we comprehend that you are undergoing a great deal, and we understand that if you are pertaining to us that you have been with a whole lot. https://www.metal-archives.com/users/pacificpr1me. Because of that, we provide you a complimentary assessment to go over your problems and see exactly how we can best help you

Since of the COVID pandemic, court systems have been closed, which negatively influences auto mishap instances in a remarkable means. Again, we are here to aid you! We happily offer the individuals of Suffolk Area and Nassau Area.

An insurance plan is a legal contract between the insurance policy firm (the insurer) and the individual(s), organization, or entity being guaranteed (the insured). Reviewing your policy assists you confirm that the policy satisfies your needs and that you comprehend your and the insurance policy firm's obligations if a loss happens. Several insureds buy a policy without comprehending what is covered, the exemptions that take away protection, and the conditions that must be met in order for coverage to use when a loss happens.

It identifies that is the guaranteed, what threats or building are covered, the plan restrictions, and the plan duration (i.e. time the plan is in pressure). The Declarations Page of a life insurance policy will certainly include the name of the person insured and the face quantity of the life insurance coverage policy (e.g.

This is a summary of the major assurances of the insurance policy firm and specifies what is covered.

Unknown Facts About Pacific Prime

Life insurance coverage plans are normally all-risk plans. https://sitereport.netcraft.com/?url=https://www.pacificprime.com. The 3 major kinds of Exclusions are: Left out dangers or reasons of lossExcluded lossesExcluded propertyTypical instances of omitted risks under a homeowners policy are.